Last Updated:

AMFI December data shows net equity inflow fell 6 percent to Rs 28,054 crore, while Gold ETFs surged 211 percent to Rs 11,646 crore.

Gold ETFs Attract Rs 11,646 Crore in December as Equity Inflows Fall 6%

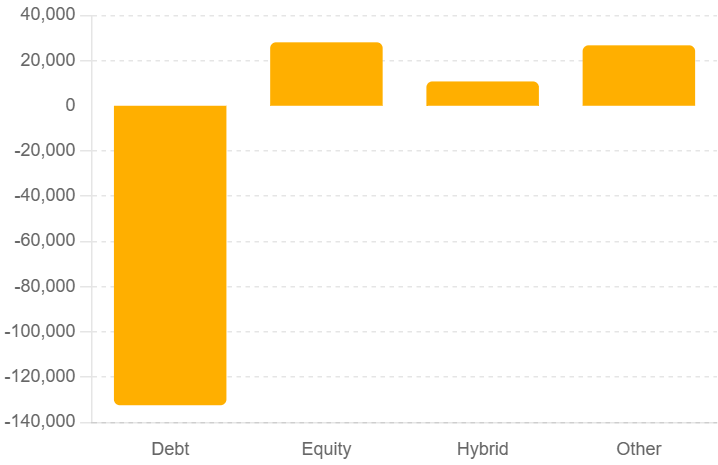

AMFI December Data: Net equity inflows in December stood at Rs 28,054 crore, reflecting a 6 per cent month-on-month decline from Rs 29,911 crore, according to monthly data from the Association of Mutual Funds in India.

The sharp rally in gold and silver has pushed investors to shift a part of their investments towards bullion-linked assets, including gold ETFs and other ETF schemes.

AMFI’s December data shows a strong surge in net inflows into schemes related to gold ETFs and other ETFs. Net inflows into Gold ETFs jumped 211 per cent, or nearly threefold, to Rs 11,646 crore in December, compared with Rs 3,741 crore in November. The total AUM of Gold ETFs stood at Rs 1,27,896 crore at the end of December.

Similarly, other ETF schemes attracted Rs 13,199.44 crore in December, a sharp rise of 35 per cent from Rs 9,720.74 crore in November.

Himanshu Srivastava, Principal Research, Morningstar Investment Research India argued that it indicates a phase of consolidation rather than any meaningful shift in investor sentiment. “Flows remained resilient despite intermittent market volatility, supported by steady SIP contributions and continued confidence in India’s long-term growth outlook,” he added.

Flexi-cap funds witnessed a sharp pickup in inflows, reflecting investor preference for strategies that offer allocation flexibility across market capitalisations amid evolving market conditions, stated Srivastava.

January 09, 2026, 12:03 IST

Read More